When Does the Music Stop on MAG7 Capex?

Quick Summary

The MAG7 hyperscalers are approaching the financial limits of what they can spend on datacenters. No one is building beyond 2 GW yet, and a 10 GW datacenter would cost ~$500B — more than any single company’s free cash flow. Meta is already maxed out; Google has the most room to grow. The path to 10 GW scale is probably a distributed fleet approach, with the earliest realistic timeline around 2030. Meaningful model improvements should continue through the 1-2 GW era, then slow significantly until the next order of magnitude in scale arrives.

Arguably the easy road for AI investing was the last 3 years. Scaling laws held, and it was extremely obvious that we had a paradigm shift when ChatGPT was launched. But the next few years are murky: we will have a situation where all of the new models will keep getting better once the next generation of larger datacenters is available for training, but after that we might hit a stall point.

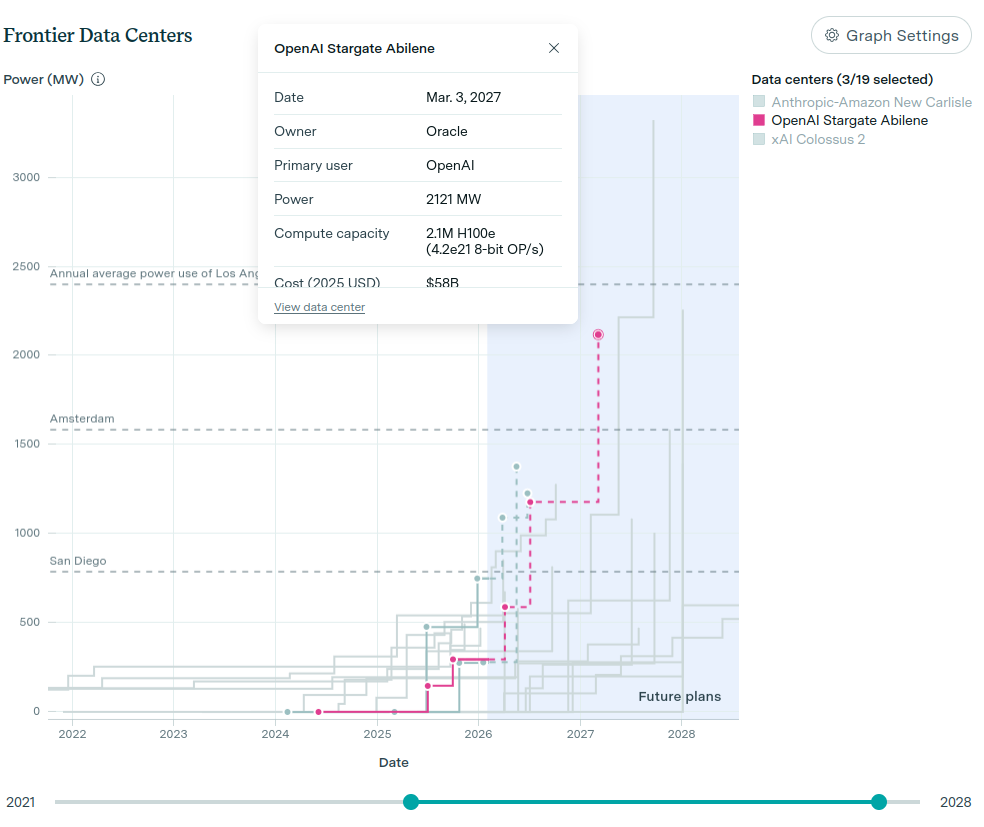

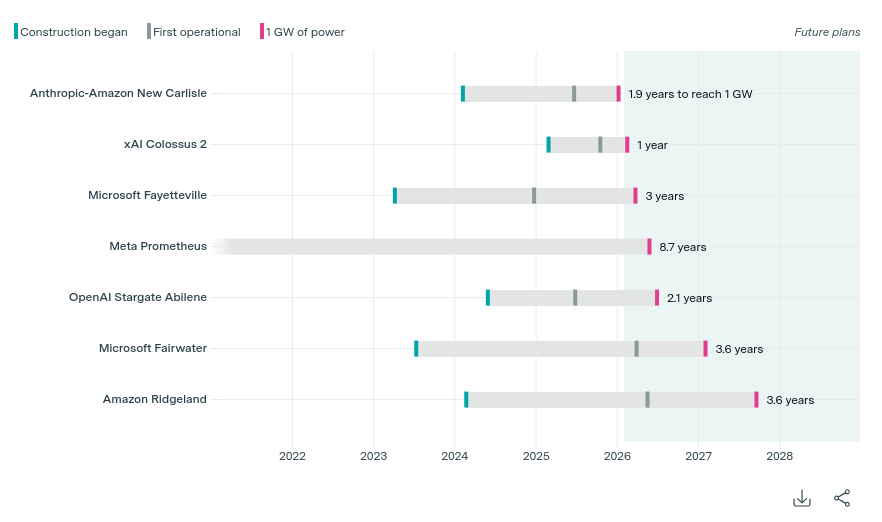

Soon all the major labs will have 1 GW datacenters. Some will even have 2 GW datacenters in a little over a year (OpenAI’s Stargate projected in March 2027), but there are no planned 5 GW or 10 GW datacenters that I’m aware of.

source: Epoch.ai first 2GW datacenter

source: Epoch.ai first 2GW datacenter

The gains will have to come from limited chip upgrades and algorithmic advances, because at some point we exhaust the physical and financial capabilities of scale to build these things.

The Current State of Play

By the end of the year, there may be as many as 4 or 5 1 GW datacenters (source: Epoch.ai).

source: epoch.ai comparison of 1gw datacenters

source: epoch.ai comparison of 1gw datacenters

Let’s look at each of the major players and figure out how much they can spend.

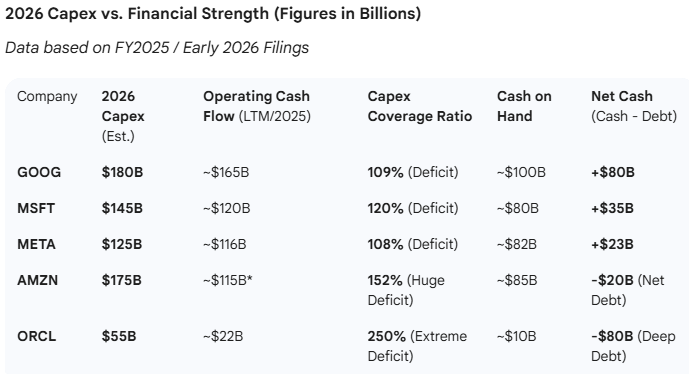

source: FY2025 / early 2026 filings

Note: this is an unsourced table from Twitter; I’m not sure who made it, but it’s in the ballpark. Let’s break down some details, since we know the actual guidance now, some of these companies clearly could go into debt to cover capex.

source: FY2025 / early 2026 filings

Note: this is an unsourced table from Twitter; I’m not sure who made it, but it’s in the ballpark. Let’s break down some details, since we know the actual guidance now, some of these companies clearly could go into debt to cover capex.

Microsoft

Microsoft spent 64.6 billion on datacenter capex in 2025. They have 43.2 billion in debt, though they’re net cash positive by 49 billion. But in the latest quarter, spending was 37 billion alone, so looking forward, that’s closer to 120 billion annualized. They have a lot of lease commitments with neoclouds that are a little complex to track.

You can see below that Microsoft is already pretty close to tapped out on their spending potential. But they do have other options, including stopping share buybacks - and to be clear, they are still doing share buybacks (imo they should stop those).

| Year | Revenue ($B) | CFO ($B) | Dividends ($B) | Buybacks ($B) | Capex capacity after dividends ($B) | Capex capacity after div+buybacks ($B) | Actual cash capex ($B) |

|---|---|---|---|---|---|---|---|

| FY2025A | 281.7 | 136.2 | 24.1 | 18.4 | 107.1 | 88.7 | 64.6 |

| FY2026E | 318.3 | 156.0 | 28.1 | 21.8 | 122.9 | 101.1 | |

| FY2027E | 353.4 | 173.1 | 31.2 | 24.2 | 137.0 | 112.7 | |

| FY2028E | 388.7 | 190.5 | 34.3 | 26.7 | 151.2 | 124.5 | |

| FY2029E | 423.7 | 207.6 | 37.4 | 29.1 | 165.2 | 136.2 | |

| FY2030E | 457.6 | 224.2 | 40.4 | 31.4 | 178.9 | 147.5 |

Google is in the best spot by far: they have 71 billion in net cash and way larger buybacks they could cut back on. They could dramatically increase capex if they curtailed buybacks. They only have 21 billion in debt today as well. They said they did 75 billion in capex in 2025. So they are already spending up towards their limits, but they could free up a lot more cash if they wished.

| Year | Revenue ($B) | CFO ($B) | Dividends ($B) | Buybacks ($B) | Capex capacity after div ($B) | Capex capacity after div + buybacks ($B) | Capex ($B) | Funding gap: capex+div+bb − CFO ($B) |

|---|---|---|---|---|---|---|---|---|

| FY2024A | 350.0 | 125.3 | 7.4 | 62.2 | 117.9 | 55.7 | 52.5 | -3.2 |

| FY2025E | 400.0 | 152.0 | 10.0 | 55.0 | 142.0 | 87.0 | 92.0 | 5.0 |

| FY2026E | 440.0 | 167.2 | 10.0 | 50.2 | 157.2 | 107.0 | 105.6 | -1.4 |

| FY2027E | 479.6 | 182.2 | 10.9 | 54.7 | 171.3 | 116.6 | 110.3 | -6.3 |

| FY2028E | 518.0 | 196.8 | 11.8 | 59.0 | 185.0 | 126.0 | 114.0 | -12.0 |

| FY2029E | 554.2 | 210.6 | 12.6 | 63.2 | 198.0 | 134.8 | 110.8 | -23.9 |

| FY2030E | 587.5 | 223.2 | 13.4 | 67.0 | 209.8 | 142.9 | 105.7 | -37.1 |

Amazon

A bit more murky here - long-term debt of 50 billion, 94 billion in cash. The column to look at here is OCF (operating cash flow minus capex), which is more variable. You can see they have some room to maneuver, but not tons; they are already spending most of their cash flow on AWS datacenter capex. Amazon also doesn’t have a big buyback operation going, and they already do not pay any dividends.

| Year | Revenue | Operating cash flow | Cash capex (net) | Est. AWS datacenter capex (65%) | OCF – capex | Long-term debt | Long-term lease liab |

|---|---|---|---|---|---|---|---|

| 2024A | 638.0 | 115.9 | 77.7 | 50.5 | 38.2 | 52.6 | 78.3 |

| 2025E | 713.5 | 138.0 | 125.0 | 81.2 | 13.0 | 52.0 | 84.7 |

| 2026E | 784.8 | 153.0 | 140.0 | 91.0 | 13.0 | 57.0 | 90.0 |

| 2027E | 855.5 | 171.1 | 145.0 | 94.2 | 26.1 | 62.0 | 95.0 |

| 2028E | 923.9 | 189.4 | 145.0 | 94.2 | 44.4 | 62.0 | 98.0 |

| 2029E | 988.6 | 207.6 | 140.0 | 91.0 | 67.6 | 62.0 | 100.0 |

| 2030E | 1047.9 | 225.3 | 135.0 | 87.8 | 90.3 | 62.0 | 102.0 |

Meta

Meta is spending as much as they can right now: 58 billion in debt, 91 billion in cash, but notably they did zero buybacks in Q4 2025. Over the next few years, they are definitely already tapped out or planning to be, with deeply negative FCF. I think they will likely (prudently) stop buybacks instead of taking on so much debt. But they could most likely cover it!

| Year | Revenue ($B) | CFO ($B) | Capex incl finance leases ($B) | Dividends ($B) | Buybacks ($B) | FCF after capex + div + bb ($B) |

|---|---|---|---|---|---|---|

| 2025A | 200.97 (1) | 115.80 (1) | 72.22 (1) | 5.32 (1) | 26.26 (1) | 12.00 |

| 2026E | 225.09 | 123.80 | 125.00 (115-135 guided) (1) | 5.59 | 25.00 | -31.79 |

| 2027E | 247.60 | 136.18 | 130.00 | 5.87 | 25.00 | -24.69 |

| 2028E | 269.88 | 148.43 | 125.00 | 6.16 | 25.00 | -7.73 |

| 2029E | 291.47 | 160.31 | 115.00 | 6.47 | 25.00 | 13.84 |

| 2030E | 311.87 | 171.53 | 105.00 | 6.79 | 25.00 | 34.73 |

xAI

There isn’t really even any point to model xAI today. We don’t know many public numbers, and we know they don’t have a lot of revenue yet. Their spending is highly constrained based on what they can raise.

From the infamous interview with Sulaiman Ghori, they seem to be pursuing a virtual employees approach. If this works, they could generate a lot of revenue. Also, xAI is rumored to be merging with SpaceX and going public. Wild times - so anyway, let’s not model this one.

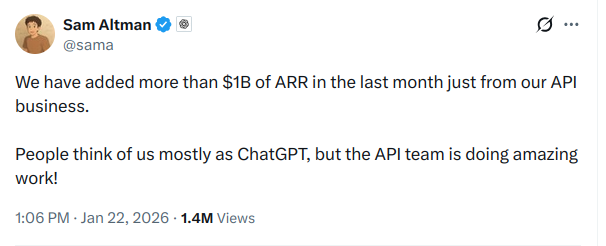

OpenAI

OpenAI: we know it closed 2025 at a 20 billion revenue run rate. And we know that Sam Altman tweeted that their enterprise segment added 1 billion in ARR just in December alone.

Just for argument’s sake, we can model all of their revenue going toward capex & compute (obviously there are salaries, but they are probably dwarfed by compute spend). This is also wrong because they are successfully and aggressively raising probably the largest private rounds ever raised now.

| Year | Revenue/ARR ($B) | YoY Growth | Implied Compute Capacity ($B) |

|---|---|---|---|

| 2024A | 6.0 | 3.0x | 6.0 |

| 2025A | 20.0 | 3.3x | 20.0 |

| 2026E | 46.0 | 2.3x | 46.0 |

| 2027E | 92.0 | 2.0x | 92.0 |

| 2028E | 147.0 | 1.6x | 147.0 |

| 2029E | 176.0 | 1.2x | 176.0 |

| 2030E | 200.0 | 1.1x | 200.0 |

Anthropic

Anthropic also has strong revenue growth - estimated at 9 billion annualized at the end of 2025. It’s projected to have something like 25 billion in revenue annualized by the end of 2026.

I think if we make the same assumptions, we can say for argument’s sake they are spending all of their revenue on compute and capex.

| Year | Revenue/ARR ($B) | YoY Growth | Implied Compute Capacity ($B) |

|---|---|---|---|

| 2024A | 1.0 | - | 1.0 |

| 2025A | 9.0 | 9.0x | 9.0 |

| 2026E | 18.0 | 2.0x | 18.0 |

| 2027E | 55.0 | 3.1x | 55.0 |

| 2028E | 70.0 | 1.3x | 70.0 |

| 2029E | 105.0 | 1.5x | 105.0 |

| 2030E | 148.0 | 1.4x | 148.0 |

Combined view

As you can see above, Meta is the one hyperscaler that is in max spending mode. Amazon, Microsoft and Google (especially) could actually spend significantly more.

Another one we didn’t talk about that could spend a lot more is Apple, but they seem content to just pay Google for model access and have been embarrassing with their AI progress for years now (I’m probably going to switch back to Android at this point, it’s such a joke). Here is a more full chart showing yearly possible capex spend with some forward projections.

| Year | Microsoft | Amazon (AWS DC) | Meta Platforms | Apple (est.) | Nvidia (est.) | Tesla (est.) | Mag7 total | OpenAI (spend proxy) | xAI (est.) | Anthropic (spend proxy) | Labs total | Total (gross) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 107.1 | 142.0 | 81.2 | 110.5 | 3.0 | 2.0 | 1.7 | 447.5 | 20.0 | 10.0 | 9.0 | 39.0 | 486.5 |

| 2026 | 122.9 | 157.2 | 91.0 | 118.2 | 3.5 | 2.5 | 4.0 | 499.3 | 46.0 | 20.0 | 18.0 | 84.0 | 583.3 |

| 2027 | 137.0 | 171.3 | 94.2 | 130.3 | 4.0 | 3.0 | 4.5 | 544.3 | 92.0 | 25.0 | 55.0 | 172.0 | 716.3 |

| 2028 | 151.2 | 185.0 | 94.2 | 142.3 | 4.5 | 3.5 | 5.0 | 585.7 | 147.0 | 25.0 | 70.0 | 242.0 | 827.7 |

| 2029 | 165.2 | 198.0 | 91.0 | 153.8 | 5.0 | 4.0 | 5.0 | 622.0 | 176.0 | 20.0 | 105.0 | 301.0 | 923.0 |

| 2030 | 178.9 | 209.8 | 87.8 | 164.7 | 5.5 | 4.5 | 5.0 | 656.2 | 200.0 | 20.0 | 148.0 | 368.0 | 1024.2 |

The 10 GW datacenter question

So if a 1 GW datacenter costs 50 billion, then a 10 GW datacenter costs 500 billion. None of these companies have that much FCF to fund something of that magnitude. Even out through 2030, only some of these companies could begin to build a 10 GW datacenter if it was a multiyear project.

How soon could one be built and will we stall out in the meantime between the 1-2 GW level and the next order of magnitude in scale?

In one sense, between all the big players we are building a combined 10 GW datacenter each year.

So really we have 2 options:

- A single massive 10 GW campus

- A 10 GW fleet of multiple datacenters that can be used as one logical DC for training.

The latter seems possible. It looks like this:

- 2026-2028: first 1-2 GW come online

- 2028-2032: scale from 2 GW to 10 GW by repeating a proven design across multiple sites, in parallel.

I think this is what OpenAI and Microsoft are doing with their Stargate project. The earliest we can possibly get there, I think, is around 2030.

Investing implications

What this really means is I think you will see meaningful model improvements from now to 1 GW. Then from 1 GW to 2 GW and 3 GW. And then after that it’s going to be much slower to the next order of magnitude.

Then once we start nearing the 10 GW scale, a true stall will begin just due to financial constraints.

So I agree with what some commentators have said: either we hit AGI & ASI via scaling by around 2030-ish or it’s like another 10 years or 20 years down the line (but considering we haven’t even seen a 1 GW-scale model yet and GPT5.2 and Opus 4.5 are incredible, there is no reason to be bearish, IMO).

However, I do believe there is a significant set of other ways to scale, including the following paths:

- Adding more memory to models (for context, and parameter size)

- Discovering more efficient algorithms to base the models on

- Making computing breakthroughs in GPU technology.

These three things are going on in parallel as we simply build bigger datacenters. So when you are investing, you can effectively invest in each of these categories:

- Compute providers (scale): Azure, AWS, GCP, CoreWeave, etc.

- GPU, TPU, etc. providers: Nvidia, Broadcom, AMD, etc.

- Memory makers: Micron, Hynix, Samsung, Sandisk, etc.

- The model makers (algorithmic breakthroughs): OpenAI, Anthropic, xAI, Google, various Chinese companies.

It should be somewhat clarifying to look at the next 5-10 years through this lens of what gets us more capabilities. Each of these stories should have a time to buy and sell, and they won’t always overlap. I’ll let the two charts below tell the story for a single year:

previously - largest ai datacenter clusters over the next 2 years