The Macro Financial Cyberpunk Future

Quick Summary

Western governments are running unsustainable debt/GDP ratios and have four levers to pull: GDP growth, rate suppression, inflation, and manufacturing new demand for Treasury debt via stablecoins. The likely outcome of running all four simultaneously is a technocapital acceleration scenario where mega-cap corporations, armed with trillion-dollar market caps as money printers, become more economically powerful than most nation-states. High valuations are not just a bubble — they are a real weapon that lets these companies raise capital, crush competitors, and compound their advantages indefinitely.

A quick summary of our current situation.

Study this table very closely:

| Year | SPY % | QQQ % | CPI YoY range % | Fed funds range % | Debt/GDP % (Q4, gross) |

|---|---|---|---|---|---|

| 2010 | 15.06 | 19.91 | 1.0 – 2.6 | 0.00 – 0.25 | 91.6 |

| 2011 | 1.90 | 3.38 | 1.6 – 3.9 | 0.00 – 0.25 | 96.1 |

| 2012 | 15.99 | 18.11 | 1.4 – 2.9 | 0.00 – 0.25 | 100.1 |

| 2013 | 32.31 | 36.63 | 1.0 – 2.0 | 0.00 – 0.25 | 99.8 |

| 2014 | 13.46 | 19.18 | 0.8 – 2.1 | 0.00 – 0.25 | 101.3 |

| 2015 | 1.23 | 9.44 | −0.2 – 0.7 | 0.00 – 0.50 | 102.6 |

| 2016 | 12.00 | 7.10 | 0.8 – 2.1 | 0.25 – 0.75 | 104.6 |

| 2017 | 21.71 | 32.66 | 1.6 – 2.7 | 0.50 – 1.50 | 102.3 |

| 2018 | −4.57 | −0.13 | 1.9 – 2.9 | 1.25 – 2.50 | 105.0 |

| 2019 | 31.22 | 38.96 | 1.5 – 2.3 | 1.50 – 2.50 | 105.8 |

| 2020 | 18.33 | 48.62 | 0.1 – 2.5 | 0.00 – 1.75 | 125.7 |

| 2021 | 28.73 | 27.42 | 1.4 – 7.0 | 0.00 – 0.25 | 119.5 |

| 2022 | −18.18 | −32.58 | 6.5 – 9.1 | 0.00 – 4.50 | 117.5 |

| 2023 | 26.18 | 54.86 | 3.0 – 6.4 | 4.25 – 5.50 | 120.2 |

| 2024 | 24.89 | 25.58 | 2.4 – 3.5 | 4.25 – 5.50 | 121.9 |

| 2025 (YTD) | 13.31% | 17.2% | 3.5 – 2.9 | 4.25 – 4.00 | 123.9 |

What do you notice…?

Do you see NASDAQ returns accelerating? Do you see Debt/GDP and inflation blowing out in recent years? Do you see inflation spiking and Debt/GDP dropping?

Don’t think about the details of every year, just look at the numbers and notice the trend.

Possible scenarios forward.

I believe the MMT / Keynesian analysis that debt/GDP doesn’t matter as long as GDP growth is above the growth of debt & deficits. I think that is pretty obviously true.

However, in recent years debt/GDP has ballooned out of control at the same time rates have risen to drastically increase the amount we have to pay to service the debt.

This is obviously not sustainable. So what are the options:

- We can grow GDP at gt 4% a year. (HARD & basically uncontrollable)

- We can drop fed funds rate down as low as possible & control the long end of the yield curve (DOABLE, but side effects)

- We can create a lot of inflation to melt away the debt in nominal terms (DOABLE, but side effects)

- We can organically create demand for treasury debt in order to force down rates and borrowing costs (HARD & basically uncontrollable)

Realistically, I believe various people in power are pursuing all of these options. And they might all work to some degree.

1. GDP growth

It’s possible to accelerate GDP growth, it’s not exactly something a policymaker can directly control though. It seems that this could happen with AI, but it’s a little early to say. Certainly if we get humanoid robots there will be incredible GDP growth.

I think the current administration is doing everything they can to push AI. But I also think as a side effect they are creating a lot of very overvalued private and public equities.

The side effect to this one is currently we are making a stock bubble.

2. Drop Fed funds rate and do YCC

I think this is happening. The Fed & the Treasury are able to work together in times of crisis to drop rates and control the yield curve. So if you control the short end with policy and you control the long end with market activities (buy debt onto the Fed balance sheet), you can do this.

The side effect of doing QE and increasing the Fed balance sheet is that you may create asset inflation, and also could affect the value of the dollar negatively.

Given that we are already creating an asset bubble, this is a dangerous combo.

3. Create inflation

This is also something that can happen, especially as a side effect of increased asset prices and investment activity & GDP growth. If you run the economy hot, it’s likely prices will rise.

Additionally, we know for a fact they simply do stimmy checks to the public and create inflation. However, if your goal is reduction of Debt/GDP, that is counterproductive.

I think at best, they will not actively try to create inflation; they will simply ignore it if it happens because it works in their favor.

4. Create new demand for Treasury debt

This one is also happening. The genius act is law now. Stablecoins are regulated and Bessent is actively encouraging this. Bo Hines quit the White House job to become Tether Americas’ new Strategic Advisor.

The stablecoin issuers hold T-bills & then issue dollars onto blockchains.

Current Tether market cap: 171.5 billion Current USDC market cap: 74 billion. Current USDe market cap: 14 billion

Why won’t these multiply into trillions as we dollarize the entire planet?

Every other western government

By the way, we are talking about the USA, but many other western countries look the same. Canada, France, the UK; they are all facing the same Debt/GDP issue.

The cyberpunk future

The backdrop:

- every major western government in precarious political & fiscal situation

- massive economic acceleration & upheaval

- running everything hot to fix debt/gdp

The outcome:

Megacorporations become more powerful than governments as business cycles are suppressed & governments walk a tightrope.

Take this chart (publics as of today!):

| Rank | Company | Ticker | Country | Sector | Market cap (USD) |

|---|---|---|---|---|---|

| 1 | NVIDIA | NVDA | USA | Info Tech | $4.301T |

| 2 | Microsoft | MSFT | USA | Info Tech | $3.849T |

| 3 | Apple | AAPL | USA | Info Tech | $3.643T |

| 4 | Alphabet | GOOG | USA | Comm Svcs | $3.084T |

| 5 | Amazon | AMZN | USA | Cons Disc | $2.468T |

| 6 | Meta Platforms | META | USA | Comm Svcs | $1.955T |

| 7 | Broadcom | AVGO | USA | Info Tech | $1.628T |

| 8 | Saudi Aramco | 2222.SR | Saudi Arabia | Energy | $1.578T |

| 9 | Tesla | TSLA | USA | Cons Disc | $1.416T |

| 10 | TSMC | TSM | Taiwan | Info Tech | $1.373T |

Yep. Here are the biggest privates rn, using the latest disclosed primary rounds or company buybacks; I flag “rumor/secondary” where it isn’t closed.

| Rank | Company | Country | Sector | Latest valuation (USD) | Source date | Basis |

|---|---|---|---|---|---|---|

| 1 | OpenAI | US | AI | ~$500B | Aug 2025 | Primary funding closed; separate employee sale at ~$500B is in talks. |

| 2 | SpaceX | US | Space/Comms | ~$400B | Jul 2025 | Insider share sale plan. |

| 3 | ByteDance | CN | Social/AI | >$330B | Aug 2025 | Employee buyback. |

| 4 | XAI | US | AI, Social Media | $200B | Sep 2025 | Latest raise |

These companies are incredibly large, effective operators, ruthlessly competitive and able to pull the levers of power. They are multinational and move around and operate in ways to their advantage across borders as needed.

This is not the dot-com bubble. These companies have real and huge earnings, they employ many people around the globe and they produce real products. They earn more money each year than many smaller countries. They are basically all USA-based but that doesn’t really matter. They are global.

Market Caps & High Valuations Are Weapons

The valuations are not just a bubble. They are real - each of these companies has a money printer called “At The Money Stock Offering”.

Tomorrow if Nvidia needs 10 billion dollars they can create 10 billion dollars worth of shares and sell them on the open market.

It will not even dent the stock price. The stock does like 300 billion in trading volume a day.

That is real power they are capable of wielding, they can buy and invest in every competitive threat, they can use capital to erect a fortress.

Even if, say, for example, one of these companies (like XAI) is currently operating at a massive loss, they can raise money and sell shares on the basis of hype and keep going until they become profitable, which after a certain escape velocity is reached actually works.

Meta this year will probably spend almost all of its free cash flow building data centers and investing in other capex related to AIs. It doesn’t even matter, the stock is at an all-time high and they can issue more shares to get more cash to build more data centers.

The higher stocks go, the bigger the bubble grows, the more REAL money these companies can capture and increase their power permanently.

A downturn is inconsequential: do layoffs and pause spend. Wait until conditions are good and then hit the gas pedal.

This is the new reality of technocapital acceleration.

AI bubble

Every day I see macro doomer podcasters talk about the “AI bubble”. We may be overspending on capex, that’s true, but I think you are seeing a lot of spending and buildouts starting from zero (like XAI) which is artificially inflating these numbers. And I think the comparisons to railroads and “dark fiber” in the 2000s are completely unwarranted. This stuff is generating revenue TODAY.

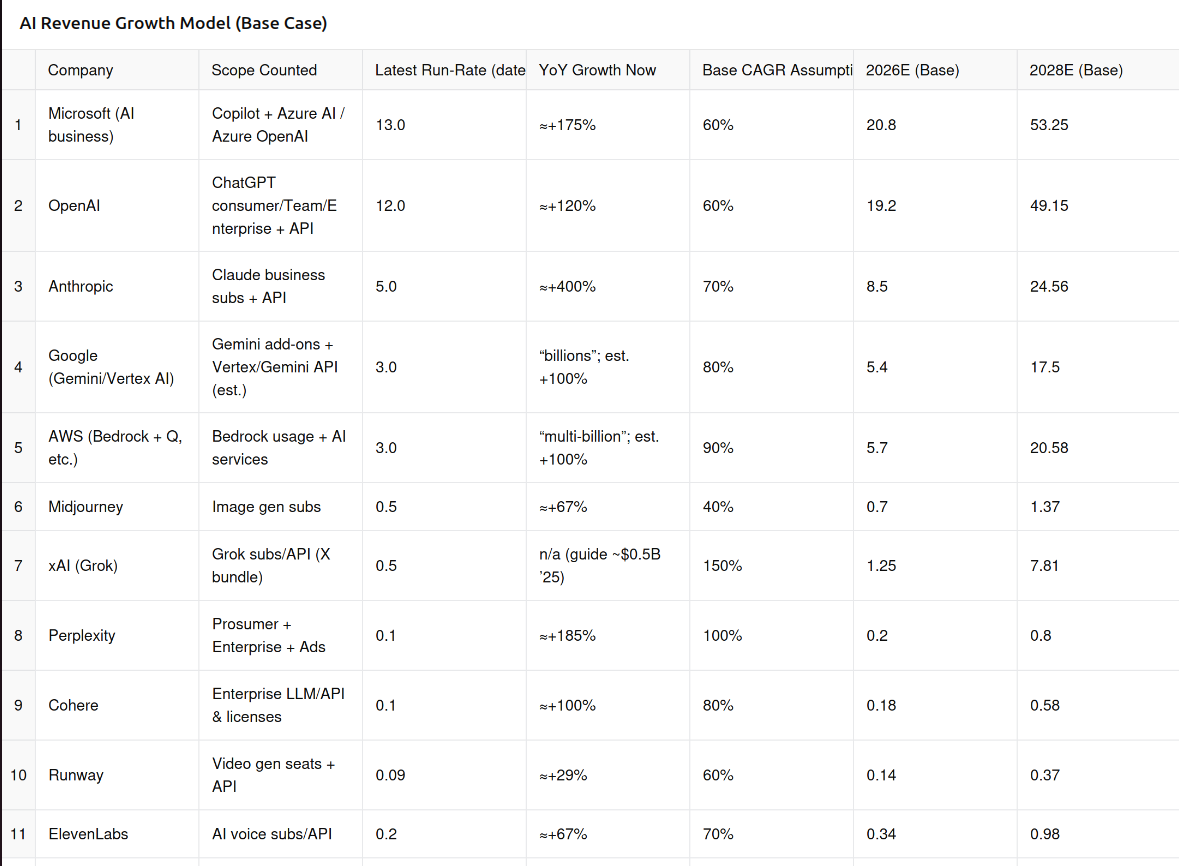

I think with a sandbagged estimate based on if you suppose current run rate of revenue growth slows dramatically you will have both OpenAI and Microsoft each generating 50 billion in revenue from AI by 2028. Anthropic, Google and AWS Bedrock are all probably in the 20s. Eleven Labs I couldn’t get good data for, but just from personal knowledge, with how much demand there is for AI Voice, I would also guess they are close to 10 billion in revenue by then.

That’s not accounting for whatever Meta is doing with their wearables. That’s not accounting for all the new video & gaming based AI tools that will certainly be in use by then. And that’s not accounting for robotics usage. We are just projecting current revenue growth rate out a couple of years for current applications.

(All numbers in billions here)

On the other side of this, whoever survives the next downturn, and after all the mergers and combinations, I think you are going to see companies much more economically powerful than almost all nation-states.

True power, like the East India companies

You need to be looking at this and start asking questions like:

What year will most of these companies start to operate private militaries?

What year will OpenAI (or Google, or Meta) be able to blackmail and control every member of every government around the world?

What year will these companies actually be forced to seize & use the kind of power they are already capable of wielding?

You need to figure out how to get as much stake in the future as possible, now. The cards are all on the table at this point.

It’s time to read sci-fi and think about what the fictional (Weyland-Yutani, Arisaka Corp, Tyrell Corp) megacorps will end up looking like in real life.

UPDATE: A funny December 12th update to this

I looked at this AI revenue table and I noticed only 3 months later the numbers looked a little off since everyone had since reported higher run rates.

I had gpt-5.2 thinking regenerate it with updated sources from announcements:

| Company | Scope counted | Latest run-rate (date, what it is) | YoY growth now | Extrapolation basis | 2026E (base) | 2028E (base) |

|---|---|---|---|---|---|---|

| Microsoft (AI business) | Copilot + Azure AI / Azure OpenAI | 13.0 (FY25 Q2, “AI business” run-rate) (Microsoft) | +175% (Microsoft) | kept your 60% CAGR | 20.8 | 53.25 |

| OpenAI | ChatGPT consumer/Team/Enterprise + API | 20.0 (expected by year-end 2025) (Reuters) | n/a | used OpenAI internal multipliers reported externally: 2.3x (2026), 2.0x (2027), 1.6x (2028), applied to 2025 exit run-rate (Epoch AI) | 46.0 | 147.2 |

| Anthropic | Claude business subs + API | 9.0 (exit-2025 target) (Reuters) | n/a | 2026 target from Reuters; 2028 target from reporting (Reuters) | 20.0 | 70.0 |

| Google (Gemini/Vertex) | Gemini add-ons + Vertex/Gemini API | 3.0 (not disclosed; still est.) | n/a | no clean rev line item; kept your 80% CAGR (treat as placeholder) (blog.google) | 5.4 | 17.5 |

| AWS (Bedrock + Q, etc.) | AWS AI business | 3.0 (not disclosed; company only says “multi-billion”) (CRN) | “triple-digit” (stated) (CRN) | kept your 90% CAGR (placeholder) | 5.7 | 20.58 |

| Midjourney | Image gen subs | 0.3 (reported 2024 revenue; run-rate unclear) (The Guardian) | n/a | kept your 40% CAGR | 0.42 | 0.82 |

| xAI (Grok) | Grok subs/API (X bundle) | 0.5 (estimate; not a clean disclosure) (Visual Capitalist) | n/a | kept your 150% CAGR | 1.25 | 7.81 |

| Perplexity | Prosumer + Enterprise + Ads | 0.2 (ARR “approaching $200M”) (TechCrunch) | n/a | kept your 100% CAGR | 0.4 | 1.6 |

| Cohere | Enterprise LLM/API & licenses | 0.2 (reported target by end-2025) (Financial Times) | n/a | lowered base CAGR to 60% (enterprise, longer contracts) | 0.32 | 0.82 |

| Runway | Video gen seats + API | 0.09 (estimated annualized rev June 2025) (Sacra) | ~+29% (est.) (Sacra) | used 40% CAGR | 0.13 | 0.25 |

| ElevenLabs | AI voice subs/API | 0.3 (company expects >$300M ARR by EOY 2025) (ElevenLabs) | n/a | kept your 70% CAGR | 0.51 | 1.47 |