Information Gradients Lead to Technocapital Sinks

You should go around looking for information gradients where a deep well of technological information exists that the rest of the market doesn’t know about yet.

It goes hand in hand with building an accurate model of reality. If you learned about transformer architecture when GPT3 first came out and the scaling predictions it should have been a small leap to understand chip makers would benefit. It wasn’t hard to see the impact being able to zero-shot classify and manipulate unstructured data would have on the market.

If a real technological gradient exists you can be sure that technocapital will flow in.

Technocapital always flows to where it can compound most aggressively.

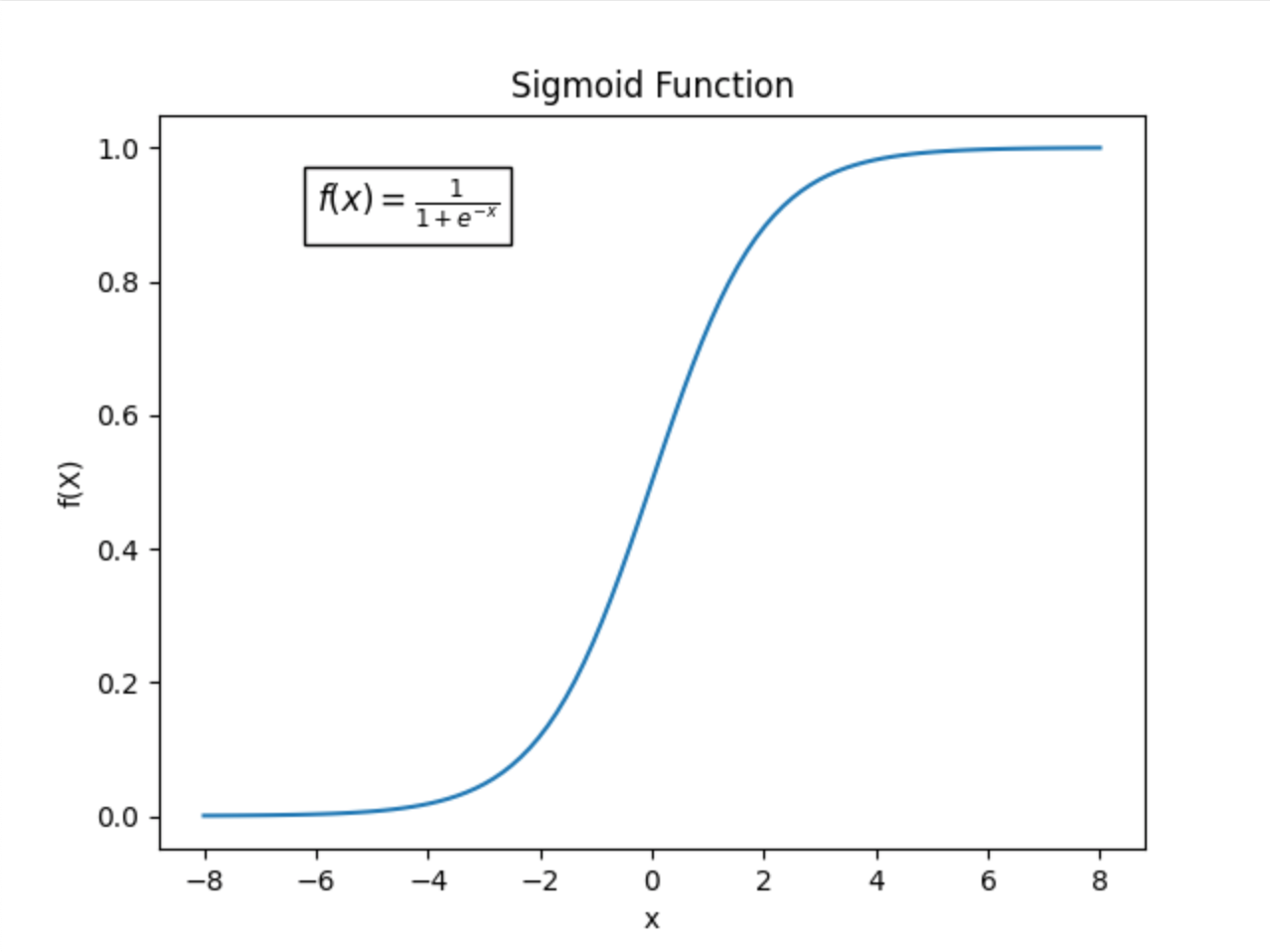

The accumulation of technocapital is like particles in nature seeking an equilibrium. But it follows a kind of sigmoid function where it is at first slowly discovered, then moves fast (giving large gains to early participants) and it kind of tails off until the capital gradient reaches some kind of homeostasis.

The depth of the technocapital sink is proportional to the market exploitability of the technology. Rich veins of technology will deeply attract capital, which will cause further advances in technology if they are profitable, but the market exploitability is very important for the cycle to accumulate more capital and not just die out or flounder.

- The internet: incredibly market exploitable, the best we have ever seen.

- Cellphones: deeply market exploitable

- AI chips: moderately market exploitable (so far)

- 3D printing: only mildly market exploitable

How do you find these information gradients?

There is only one way: you must travel to a place more technologically advanced or different in some way from larger markets.

By “travel” I mean both physically and virtually. Seek out weird corners of the internet, or go to China (or wherever the edge of information is), or parties in silicon valley.

What are you waiting for?

Vamos!